-

Integration

-

- I've updated my employees, customers, etc in QuickBooks, but I'm not ready to export time and expense entries yet.

- Can I edit entries that have already been synced?

- Can I use Minute7 if my company uses QuickBooks Online Edition?

- Changing the Account Manager in Minute7 (QuickBooks Online Accounts)

- Error message, "QuickBooks Online could not add time and expense entries because your QuickBooks Online account does not have time tracking enabled"

- Getting started: Sync Minute7 with QuickBooks Online for the first time

- How can I assign QuickBooks classes to my time entries?

- How can I delete or edit entries that have been synced with QuickBooks

- How do I change my security settings for Minute7 in QuickBooks?

- How do I change the number of hours Minute7 waits after an entry is created before exporting it?

- How do I set up my Minute7 account to sync with QuickBooks Online Edition?

- How do I transfer time entries to invoices?

- I've synced with Minute7 with QuickBooks, but Minute7 still tells me I need to sync before I can start using it.

- User guide: How to assign classes in Minute7

- User guide: How to Associate a Minute7 User With a QuickBooks Employee or Vendor.

- User guide: How to enter a 1099 into QuickBooks Online and track time in Minute7.

- User guide: How to sync Minute7 with QuickBooks Online for the first time.

- What is an "Associated Vendor for expense tracking in QuickBooks"?

- What is QuickBooks Web Connector?

- What versions of QuickBooks Online Edition will work with Minute7?

- What will Minute7 change in my QuickBooks file?

- When I sync, I get the error message, "The record of Minute7 connection in QuickBooks Online couldn't be found..."

- Which versions of QuickBooks does Minute7 work with?

- Show Remaining Articles (8) Collapse Articles

-

-

- Can I automatically sync Minute7 and QuickBooks at specific intervals?

- Can Minute7 associate QuickBooks payroll items with time entries?

- Getting started: Sync Minute7 with QuickBooks Desktop for the first time

- How can I assign QuickBooks classes to my time entries?

- How do I add payroll items and rates for an Employee in QuickBooks?

- How do I allow my employees to edit payroll items for time entries?

- How do I change my security settings for Minute7 in QuickBooks?

- How do I set the default payroll item that is used when an employee creates a time entry in Minute7?

- I've synced with Minute7 with QuickBooks, but Minute7 still tells me I need to sync before I can start using it.

- Syncing Minute7 with QuickBooks using the QuickBooks Web Connector

- User guide: How to add a payroll item into QuickBooks Desktop and Minute7

- User guide: How to add Payroll items to Minute7 and make a Default Payroll for a User

- User guide: How to assign classes in Minute7

- User guide: How to Associate a Minute7 User With a QuickBooks Employee or Vendor.

- User guide: How to enter a 1099 into QuickBooks Desktop and track time in Minute7

- User guide: How to enter a service item into QuickBooks Desktop and Minute7

- User guide: How to sync Minute7 with QuickBooks Desktop for the first time

- User guide: How to sync Minute7 with QuickBooks Desktop for the first time.

- What is an "Associated Vendor for expense tracking in QuickBooks"?

- What version of QuickBooks works with the web connector?

- When I select an Employee for a Minute7 user, I see a note that says "QuickBooks does not know the payroll status of this employee." What does this mean?

- Which versions of QuickBooks does Minute7 work with?

- Show Remaining Articles (7) Collapse Articles

-

- I've updated my employees, customers, etc in QuickBooks, but I'm not ready to export time and expense entries yet.

- Can I automatically sync Minute7 and QuickBooks at specific intervals?

- Can I edit entries that have already been synced?

- Getting started: Sync Minute7 with QuickBooks Desktop for the first time

- How can I delete or edit entries that have been synced with QuickBooks

- How do I change my security settings for Minute7 in QuickBooks?

- How do I change the number of hours Minute7 waits after an entry is created before exporting it?

- How do I get my timesheets and time entries into QuickBooks?

- How do I set up an Employee to use time data to create paychecks in QuickBooks?

- How do I transfer time entries to invoices?

- User guide: How to sync Minute7 with QuickBooks Desktop for the first time

- User guide: How to sync Minute7 with QuickBooks Desktop for the first time.

- What version of QuickBooks works with the web connector?

- What will Minute7 change in my QuickBooks file?

- Which versions of QuickBooks does Minute7 work with?

-

- What should I do if I get a QuickBooks Web Connector error "QBWC1085"

- Error: QuickBooks Desktop – Time Tracking Not Enabled

- Error: QuickBooks is having trouble determining the payroll status for one of your employees

- Error: QuickBooks is having trouble finding payroll information for on of your employees who has "Use time data to create paychecks" enabled

- Which versions of QuickBooks does Minute7 work with?

-

-

- Articles coming soon

-

-

Timekeeping

-

- Can I have users and time entries associated with vendors?

- How can I assign QuickBooks classes to my time entries?

- How can I enter billable and unbillable time?

- How do I control whether my time entries are grouped by week or shown individually?

- How do I get my timesheets and time entries into QuickBooks?

- How do I restart my timer?

- How do I set the default payroll item that is used when an employee creates a time entry in Minute7?

- How do I set up an Employee to use time data to create paychecks in QuickBooks?

- I don't see any of my employees or customers

- User guide: How to enter a 1099 into QuickBooks Desktop and track time in Minute7

- User guide: How to enter a 1099 into QuickBooks Online and track time in Minute7.

- User guide: How to enter and track time with Minute7.

- User guide: How to mark an entry as billable or non-billable in Minute7.

- What are "approved" and "disapproved" time entries?

- What do I need to do before my employees begin entering time?

- What do I need to do before my employees begin entering time?

- What if I don't want to track expenses?

- Show Remaining Articles (2) Collapse Articles

-

-

Expense Management

-

- How to track your Credit Card Expenses with Minute 7?

- How to track your Reimbursable Expenses with Minute 7?

- The billing status of my expenses is not always showing up in QuickBooks. Why not?

- User guide: How to batch process time and expense entries in Minute7.

- User guide: How to enter and track expenses in Minute7.

- User guide: How to mark an entry as billable or non-billable in Minute7.

- What are expenses? How do they work in QuickBooks?

- What is an "Associated Vendor for expense tracking in QuickBooks"?

- Who can enter expenses?

- Why associate an Employee with an "Associated Vendor for expense tracking in QuickBooks"?

-

-

Minute 7 Mobile App

-

Reporting

- Articles coming soon

-

Account Administration

-

- Changing the Account Manager in Minute7 (QuickBooks Desktop Accounts)

- How do I allow my employees to edit payroll items for time entries?

- How Do I remove a user from my account?

- How do I set the default payroll item that is used when an employee creates a time entry in Minute7?

- User guide: How to add Payroll items to Minute7 and make a Default Payroll for a User

- User guide: How to assign classes in Minute7

- User guide: How to Associate a Minute7 User With a QuickBooks Employee or Vendor.

- User guide: How to enter a 1099 into QuickBooks Desktop and track time in Minute7

- What is an "Associated Vendor for expense tracking in QuickBooks"?

- When I select an Employee for a Minute7 user, I see a note that says "QuickBooks does not know the payroll status of this employee." What does this mean?

-

-

- Can I change the permissions of the account manager?

- Can I limit which "Customer: Jobs" a user can see?

- Can I limit which "Customer: Jobs" a user can see? Copy

- Can I limit which of my "Service Items" a user can see?

- How do Permissions work?

- User guide: How to Set Up Restrictions for Users.

- What happens if I don't associate a user with an employee?

- Why can't I see all of my employees in the drop-down list when I am trying to set up a user account?

-

-

-

- What should I do if I get a QuickBooks Web Connector error "QBWC1085"

- Error: QuickBooks Desktop – Time Tracking Not Enabled

- Error: QuickBooks is having trouble determining the payroll status for one of your employees

- Error: QuickBooks is having trouble finding payroll information for on of your employees who has "Use time data to create paychecks" enabled

-

-

No Integration

How to track your Reimbursable Expenses with Minute 7?

Expense tracking is much easier with Minute 7 as it allows users to track both reimbursable, and credit card expenses.

Reimbursable Expenses:

As the name implies, reimbursable expenses are those expenses which are going to be reimbursed to the employee or vendor. This workflow will generate a bill in QuickBooks after syncing the expense from Minute 7 to QuickBooks.

Example

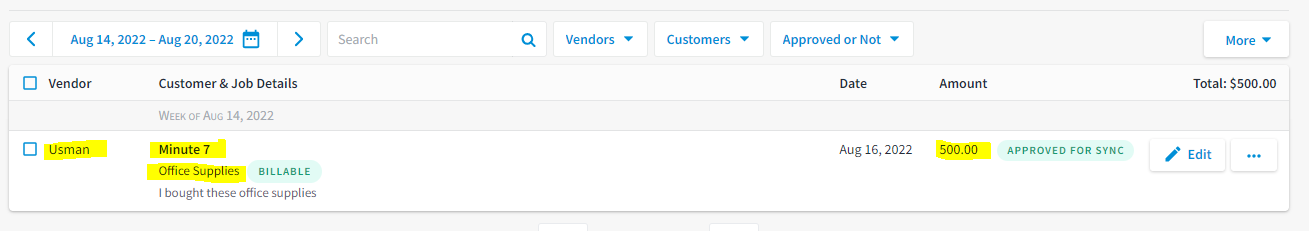

A vendor purchased $500 in office supplies for your company with his own money, and now you want your company to reimburse the $500 to the vendor, they would have to enter a reimbursable expense entry in Minute7 and (if applicable) attach a receipt in Minute 7 to get paid as shown below: The reimbursable expense entry will then be approved by the manager and synced to QuickBooks, where it will have the type “Bill” and status “Open” as shown in the screenshot below:

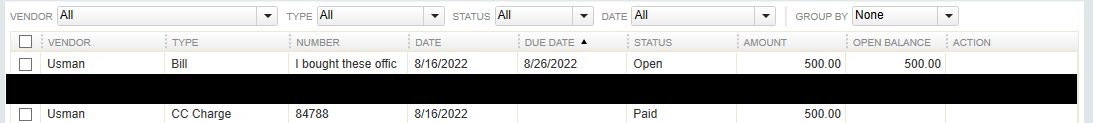

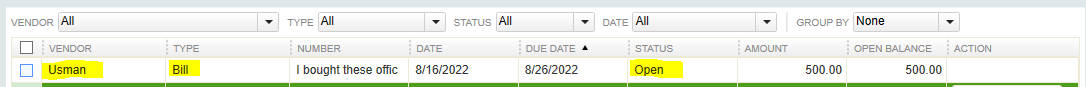

The reimbursable expense entry will then be approved by the manager and synced to QuickBooks, where it will have the type “Bill” and status “Open” as shown in the screenshot below:

Difference Between Credit Card and Reimbursible Expense Entries:

You can see the difference in QuickBooks Desktop by noticing the different status and type of two expense entries when synced with QuickBooks below: