It should go without saying that your employees and contractors are worth a lot to you. As the people who ultimately are responsible for making your business work, without their time and effort you wouldn’t be nearly as successful as you are right now.

But although it’s fair to say that the work your people do for you is priceless in one sense, it also has a hard and fast dollar value attached to it. Understanding how to determine labor costs in real-world terms is a crucial component of running your business. Not only are they usually the largest single expense you have, but keeping them under control is essential for maintaining a healthy balance sheet.

Read on to learn more about how you can and should keep track of how much you’re actually spending on labor.

How to Calculate Labor Cost With Accuracy

In the broadest sense, your labor expenses include the gross wages for each employee as well as any additional payments or benefits given on the employee’s behalf, such as Social Security taxes and health insurance plans. Knowing exactly what it costs to support your entire workforce is important because you don’t want your overhead to be greater than your revenue.

Calculating labor cost for a single employee begins with a simple formula: Labor per hour equals gross pay and other annual costs divided by the number of actual hours worked per year. For example, let’s say a single employee at your company is paid $15 per hour with a full-time schedule of 40 hours per week. Assuming that individual was employed with you for the entire calendar year and had no overtime, he or she would have worked a total of 2,080 hours that year. That means a gross pay per year of $31,200.

However, this is not the only form of compensation you pay out to your employees. You also need to factor in payroll taxes, benefits such as insurance and retirement plan contributions, and miscellaneous costs such as work supplies and workers’ compensation. These will vary depending on which state you’re in and whether you made any such contributions. Once those additional costs are added to the gross pay, you can divide by the total number of hours that person worked within the past year and have your final hourly labor cost for that individual.

Control Your Calculations

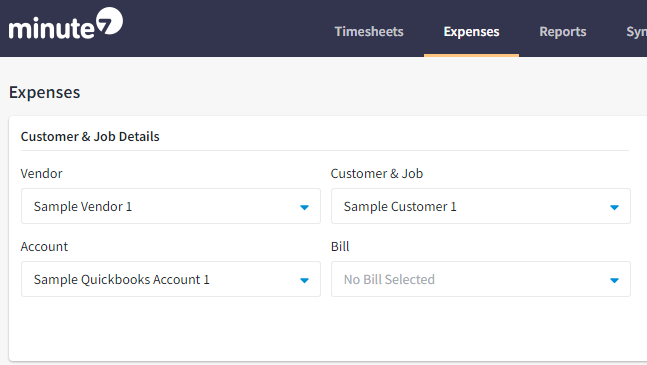

With Minute7’s comprehensive time tracking software platform, you can keep tabs on your labor expenses and make better decisions. Whether you view them on your desktop or on a mobile app, we give you the ability to analyze your labor expenses and payroll records, drilling deep into the data so you can keep everything under control. Click here to start your free trial today.