The accounting industry is undergoing a significant transformation as remote work becomes increasingly prevalent among Certified Public Accountants (CPAs). The shift towards remote work is driven by advancements in technology, changing workplace dynamics, and the lasting impacts of the COVID-19 pandemic. For CPAs, this transition brings a myriad of benefits, including enhanced flexibility, reduced overhead costs, and the ability to leverage innovative tools that facilitate seamless remote collaboration. Understanding the latest trends and essential tools in this evolving landscape is crucial for CPAs to maintain productivity, ensure data security, and stay competitive in the modern accounting world.

The Rise of Remote Work in the Accounting Industry

Remote work has significantly impacted the accounting industry, evolving from a niche practice to a mainstream approach. Initially, only about 40% of auditors had some experience working remotely, but the COVID-19 pandemic accelerated this trend dramatically. The pandemic necessitated a swift transition, prompting more accountants to adapt to remote working environments (source).

Current adoption rates of remote work among CPAs are quite high. According to a survey by Thomson Reuters, 70% of accounting firms plan to maintain remote work positions even after the pandemic (source). Another Gartner CFO Survey reveals that 74% of companies intend to permanently shift some employees to remote work post-COVID-19 (source).

The impact of the COVID-19 pandemic on remote work trends for CPAs has been profound. Research indicates that four years after the start of the pandemic, most of the largest companies in America have implemented a structured hybrid model, with the most popular being three days per week in the office (source). Additionally, a survey of accountants across 20 countries revealed that the majority of accounting firms have successfully adapted to the challenges posed by the pandemic (source).

Remote work offers several benefits to CPAs and accounting firms, including enhanced flexibility, reduced overhead costs, and improved work-life balance. It also provides access to a broader talent pool and global clients, as well as fostering technological proficiency and enhancing productivity (source). Moreover, remote work has emerged as a viable recruitment strategy, appealing to professionals seeking more flexible work arrangements (source).

In conclusion, the rise of remote work in the accounting industry, driven by the COVID-19 pandemic and other factors, has paved the way for a more flexible and efficient working environment for CPAs. This transformation can be optimally managed with the support of efficient tools like Minute7, which offers seamless time tracking and expense reporting, enhancing the productivity and convenience of remote work for accountants.

Essential Tools for Remote Collaboration

As remote work becomes the norm for Certified Public Accountants (CPAs), leveraging the right tools is crucial for maintaining productivity and ensuring effective collaboration. Here, we explore some essential tools that facilitate efficient remote work for CPAs.

Cloud-Based Accounting Software

Cloud-based accounting software is a game-changer for remote CPAs. It provides anytime access from anywhere, real-time metrics, enhanced security, and automatic updates, making it easier for accountants to manage their tasks remotely. This software ensures that data is securely stored and easily retrievable, even in the event of a disaster, enabling continuous business operations (source). By streamlining processes and offering flexibility and scalability, cloud-based solutions help CPAs stay efficient and responsive.

Communication and Project Management Tools

Effective communication is vital for remote collaboration. Tools like Microsoft Teams, Asana, Trello, and Time Doctor enable seamless communication and project management among team members. These platforms facilitate real-time interaction, task assignment, and progress tracking, ensuring that projects stay on schedule and team members are aligned (source). By providing a centralized hub for communication, these tools enhance coordination and productivity.

Secure Data Storage and Sharing Platforms

In the accounting industry, safeguarding sensitive financial information is paramount. Secure data storage and sharing platforms, such as virtual data rooms, offer robust security features to protect confidential data from unauthorized access and cyber threats. These platforms ensure compliance with industry regulations and provide a secure environment for storing and sharing critical financial documents (source). For CPAs, using secure data solutions is essential to maintain client trust and protect valuable information.

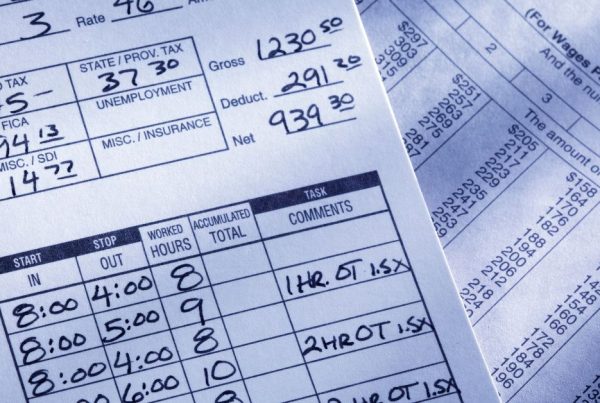

Time Tracking and Expense Reporting Tools

Accurate time tracking and expense reporting are fundamental for remote CPAs to manage resources effectively and ensure accurate billing. Time tracking tools like Minute7 simplify the process of monitoring hours worked and expenses incurred, offering features such as timesheets, mileage calculators, and receipt attachment. By integrating seamlessly with QuickBooks, Minute7 allows CPAs to sync data for billing, reporting, and payroll purposes, enhancing overall efficiency (source). Automating these tasks reduces manual data entry, allowing CPAs to focus on client relationships and strategic work.

In conclusion, adopting these essential tools can significantly enhance the remote work experience for CPAs. Cloud-based accounting software, communication and project management tools, secure data storage platforms, and time tracking solutions like Minute7 are indispensable for maintaining productivity, ensuring data security, and fostering effective collaboration in the modern accounting landscape.

Best Practices for CPAs Embracing Remote Work

As remote work becomes a staple in the accounting industry, Certified Public Accountants (CPAs) can enhance their efficiency and productivity by adhering to best practices. These practices encompass setting up an efficient home office, establishing a routine, ensuring data security, and pursuing continuous professional development.

Setting Up an Efficient Home Office: Equipment and Ergonomics

Creating a conducive home office is crucial for remote CPAs. Essential components include a reliable high-speed internet connection, communication software like Zoom and Microsoft Teams, and easy access to relevant files (source). A dedicated workspace with natural light can boost mood and productivity, and for those planning to claim a home office tax deduction, the space must be used exclusively for business purposes (source).

Ergonomics play a vital role in maintaining comfort and reducing strain during long work hours. Invest in ergonomic furniture, such as an adjustable desk and chair. Incorporating natural elements like plants and ensuring adequate lighting can further enhance the work environment (source).

Establishing a Routine and Maintaining Work-Life Balance

A well-defined routine helps maintain structure and discipline while working remotely. Setting clear work hours and taking breaks can prevent burnout and ensure a healthy work-life balance. It’s essential to switch off and disengage from work at designated times to prevent the blurring of professional and personal life (source).

Ensuring Data Security and Compliance with Industry Regulations

Data security is paramount for remote CPAs. Use dedicated business computers, run regular malware scans, and educate team members about data security risks and best practices (source). Implement strong passwords, data encryption, and strict access controls to safeguard sensitive information. Regular data backups are essential to prepare for unexpected events like cyber-attacks or hardware failures (source).

Continuous Professional Development and Staying Updated

Staying abreast of industry trends and advancements is crucial for CPAs. Online continuing professional education (CPE) courses, such as those offered by Surgent CPE, provide a variety of learning options including live webinars, on-demand webcasts, and self-study courses (source). Engaging in continuous professional development ensures that CPAs remain knowledgeable and competitive in a rapidly evolving industry.

In conclusion, remote work can be effectively managed by CPAs by setting up an efficient home office, maintaining a work-life balance, ensuring data security and compliance, and staying updated with industry trends through continuous professional development. These best practices align with the offerings of Minute7, a time tracking and expense reporting solution that integrates seamlessly with QuickBooks and offers a convenient platform for tracking time and expenses from anywhere.

Embracing the Future of Remote Work for CPAs

As the accounting industry continues to adapt to the growing trend of remote work, Certified Public Accountants (CPAs) must equip themselves with the right tools and best practices to thrive in this evolving landscape. The rise of remote work brings numerous benefits, such as increased flexibility, reduced overhead costs, and access to a broader talent pool, but it also necessitates the adoption of reliable and efficient tools to maintain productivity and ensure data security.

Minute7 stands out as an invaluable asset in this context, offering a comprehensive time tracking and expense reporting solution that integrates seamlessly with QuickBooks. This integration ensures that CPAs can effortlessly sync their data for billing, reporting, and payroll purposes, thereby streamlining their workflows and enhancing efficiency. Minute7’s user-friendly platform, accessible via web, iOS, and Android apps, provides the flexibility that remote work demands, allowing CPAs to track time and expenses from anywhere.

Moreover, by addressing common challenges such as accurate time tracking and expense management, Minute7 empowers CPAs to focus on higher-value tasks and strategic decision-making. The platform’s secure data storage and robust reporting capabilities further contribute to maintaining compliance with industry regulations and protecting sensitive financial information.

In conclusion, the future of remote work for CPAs is promising, provided they leverage the right tools and best practices. Minute7 emerges as a key player in this transformation, offering a reliable, efficient, and secure solution for time tracking and expense reporting. By adopting Minute7, CPAs can confidently navigate the remote work landscape, ensuring enhanced productivity, seamless collaboration, and sustained success in an increasingly digital world.

Explore how Minute7 can support your remote work needs by visiting Minute7’s website.