The Critical Role of Data Accuracy

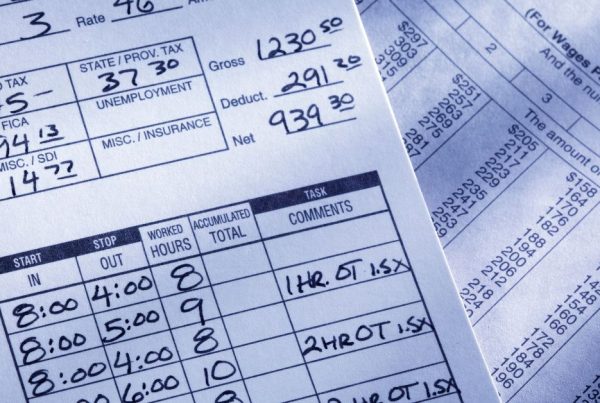

For a small business owner, the accuracy of data cannot be overstated. Accurate financial records are the bedrock of informed decision-making. Here are a few examples illustrating why precision in data matters:

- Budgeting and Forecasting: Accurate time and expense tracking ensures that budgeting forecasts are as close to reality as possible. With precise data, you can predict future costs and revenues more effectively, helping to steer the business toward financial stability and growth.

- Billing and Invoicing: When hours worked and expenses incurred are recorded with pinpoint accuracy, invoices reflect the true amount owed by the client. This not only fosters trust between the business and its clients but also ensures that the business is fully compensated for its efforts.

- Tax Reporting: Accurate data is crucial when filing taxes. Overstated expenses or understated income can lead to penalties and interest from tax authorities. Conversely, accurate reporting safeguards against paying more in taxes than necessary.

- Efficiency Improvements: Detailed, accurate records of how time and resources are spent can highlight areas of waste or inefficiency within the business. This insight allows for targeted improvements, ultimately boosting productivity and profitability.

In essence, data accuracy directly impacts a small business’s financial health, legal compliance, client relationships, and operational efficiency. Tools like Minute7 help ensure that these critical elements are not left to chance, enabling small business owners to maintain meticulous records with ease.

How Minute7 Stands Out

Minute7 distinguishes itself with a suite of features designed to accommodate the needs of small businesses and accountants. Here’s a glimpse into some of its core offerings:

- Easy Time Tracking: Users can effortlessly log time against specific clients or projects, ensuring every billable minute is accounted for.

- Expense Reporting: With Minute7, recording expenses is simplified, allowing users to quickly add expenditures and attach receipts on the go.

- Seamless Integration with QuickBooks: Minute7 integrates seamlessly with QuickBooks, ensuring that time and expense data flows directly into your accounting software, eliminating the need for manual data entry.

- Role-Based Permissions: Set permissions based on user roles, allowing for controlled access to sensitive information and ensuring data integrity.

- Mobile Accessibility: Access Minute7 on the move with its mobile app, perfect for freelancers and professionals who need to log time and expenses away from the office.

- Real-Time Reporting: Access real-time reports to gain insights into project profitability, employee productivity, and more, helping you make informed decisions quickly.

Through these features, Minute7 not only simplifies administrative tasks but also contributes to greater operational efficiency and financial health for small businesses and their accountants.

Taking the Next Step

We believe in transparent and straightforward pricing that aligns with the needs of small businesses and accountants. Our pricing model is designed to offer flexibility and affordability, ensuring that our clients only pay for what they need.

All our plans come with a risk-free, 30-day trial period, allowing you to experience the full capabilities of Minute7 before making a commitment. Additionally, we offer dedicated customer support and regularly update our platform with new features and improvements, all included at no extra cost. Upon choosing Minute7 as the ideal solution for your organization, the billing structure will be $8 monthly for each user.

We encourage you to explore what Minute7 can do for your business. Visit our website to learn more and sign up today. Experience firsthand how Minute7 can be the game-changer your business has been looking for.