In the dynamic world of freelance web development, effective expense management is crucial for maximizing profitability and ensuring business sustainability. Freelancers often encounter challenges in financial management, which can hinder their growth and success. By implementing robust strategies for tracking and categorizing expenses, utilizing advanced technology like Minute7, and understanding relevant tax deductions, freelance web developers can gain better control over their finances. This approach not only enhances financial savvy but also supports long-term stability and growth, enabling freelancers to focus more on their creative pursuits while maintaining a healthy bottom line.

Understanding Expense Categorization for Freelance Web Developers

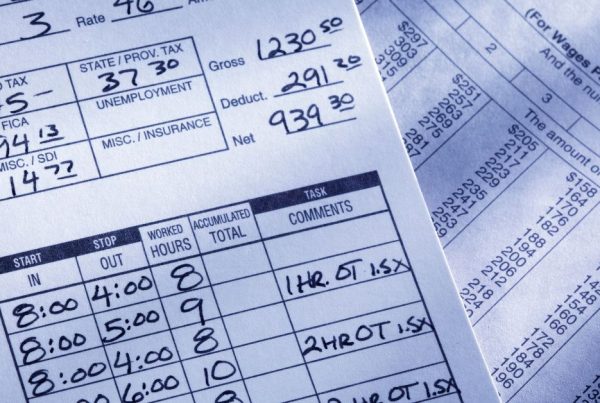

For freelance web developers, categorizing expenses is an essential step toward achieving effective financial management. Proper categorization allows freelancers to monitor spending patterns, develop better budgets, and control costs more efficiently. By systematically organizing expenses, developers can pinpoint costly areas and identify potential savings. This process also streamlines tax preparation by clearly identifying deductible expenses, ultimately reducing taxable income and overall tax liability.

Freelance web developers typically encounter a diverse range of expenses that can be grouped into several common categories:

- Software Subscriptions : Costs for essential development tools and applications such as Adobe Creative Suite or GitHub.

- Office Supplies : Items like paper, printer ink, and stationery that support daily operations.

- Travel Expenses : Costs related to client meetings, networking events, or conferences, including transportation and accommodation.

- Marketing and Promotion : Fees for website hosting, digital advertising, and promotional materials.

- Professional Development : Investment in courses, certifications, and educational resources to enhance skills.

- Equipment and Technology : Purchases of computers, monitors, and other necessary tech accessories.

To maintain accurate and organized records, freelancers can take several practical steps:

- Use Digital Tools : Employ apps and software like Minute7 for expense tracking and reporting, automating processes and minimizing errors.

- Separate Personal and Business Finances : Open a dedicated business bank account to clearly distinguish between personal and business expenses.

- Regularly Update Records : Dedicate time weekly or monthly to review and categorize expenses, preventing a backlog of receipts.

- Keep Receipts and Documentation : Store digital copies of all receipts, aiding in clean bookkeeping and tax audits.

- Consult a Professional : Engage with an accountant or financial advisor to ensure compliance with tax regulations.

Accurate categorization empowers freelance web developers to create more effective budgets, revealing spending trends and areas for cost reduction. By understanding which categories demand the most resources, freelancers can allocate funds strategically, covering essential costs while minimizing unnecessary expenses.

Leveraging Technology for Efficient Expense Tracking

Incorporating technology into expense management offers freelance web developers a multitude of benefits, making financial tasks less burdensome and more accurate. Tools like Minute7 are designed to automate and streamline the process of tracking expenses, which is vital for freelancers who need to focus on their projects rather than administrative duties. By minimizing manual errors and saving time, these tools enhance financial transparency and efficiency, leading to improved budget management and financial planning.

Automated expense tracking systems simplify the entire process by reducing the need for manual data entry, which is often a source of errors. Features such as optical character recognition (OCR) enable these systems to automatically extract data from receipts, ensuring high accuracy. This automation provides real-time data and reporting, supporting better decision-making and financial oversight. Additionally, tools like Minute7 offer seamless integration with accounting software, facilitating financial audits and enhancing compliance.

Minute7 offers several features specifically beneficial for freelance web developers:

- Mobile App : Enables freelancers to track time and expenses on the go, making it easier to manage finances from anywhere.

- Receipt Attachment : Users can take photos of receipts and attach them to expense entries, ensuring all expenses are documented and organized.

- Mileage Calculator : Calculates travel costs using the latest IRS reimbursement rates, crucial for accurate expense reporting and tax deductions.

To fully leverage these tools, freelancers should integrate them into their daily operations. This can be done by:

- Choosing the Right Tool : Select a tool that integrates well with existing systems, like accounting software, to ensure a seamless workflow.

- Automating Routine Tasks : Use features such as automated receipt scanning and categorization to minimize manual input and errors.

- Regularly Reviewing Expenses : Schedule frequent reviews of expenses to identify patterns and areas for cost savings.

- Utilizing Mobile Features : Take advantage of mobile apps to manage expenses on the move, ensuring no expense goes unrecorded.

- Training and Adoption : Ensure all stakeholders understand how to use the tool effectively, which can often involve a brief training session or tutorial.

By adopting these strategies, freelance web developers can significantly enhance their expense management processes, leading to greater financial efficiency and profitability.

Maximizing Profitability Through Tax Deductions and Savings

Understanding and leveraging tax deductions is vital for freelance web developers aiming to maximize profitability. By identifying deductible expenses, freelancers can lower their taxable income, thus decreasing their overall tax liability. Key deductions include the home office deduction , which allows developers to deduct expenses related to the portion of their home used exclusively for business. This can be calculated using a simplified method or by determining actual expenses proportionate to the office space.

Another significant area is the deduction for software and tools , which covers essential subscriptions and services necessary for development work. Similarly, costs related to educational expenses , such as courses and certifications that enhance skills, qualify as deductions if they maintain or improve business competencies. Other deductible expenses include business-related equipment and supplies and a portion of internet and utilities .

Accurate and detailed tracking of these expenses is crucial for maximizing deductions. Freelancers should keep meticulous records of all deductible expenses, such as advertising and marketing costs , travel, meals, and insurance premiums .

To effectively manage these deductions, freelance web developers can implement robust expense tracking systems. Using digital tools designed for expense management, like Minute7 , ensures all expenses are recorded accurately, facilitating significant tax savings. Additionally, separating business and personal finances by opening a dedicated business account can simplify expense tracking and financial reporting.

Preparing for tax season with organized financial records is also essential. Regular updates and organization of income and expense documents reduce stress and errors during filing. Consulting with a tax professional can further ensure compliance and maximize tax benefits, especially in complex situations.

By effectively managing and documenting expenses, freelance web developers can capitalize on tax deductions, resulting in substantial savings and increased profitability.

Enhancing Profitability with Effective Expense Management

Freelance web developers can significantly enhance their profitability by adopting a strategic approach to expense management. By categorizing expenses accurately, leveraging technology like Minute7 , and maximizing tax deductions, developers can ensure a streamlined financial process that supports sustainable growth. Minute7 offers a robust platform that simplifies expense tracking, integrates seamlessly with QuickBooks, and provides essential tools such as mobile apps and mileage calculators, all tailored to meet the unique needs of freelancers.

The journey towards better financial management begins with understanding and organizing expenses into meaningful categories, allowing freelancers to monitor their spending effectively and identify areas for cost reduction. This organized approach not only aids in budgeting but also facilitates the identification of tax-deductible expenses, leading to significant savings.

Incorporating technology into daily operations further amplifies these benefits. Tools like Minute7 automate tracking, reduce manual errors, and provide real-time insights into financial health, enabling better decision-making and financial planning. This allows freelancers to focus more on their craft while maintaining a clear understanding of their financial status.

Finally, by proactively managing tax deductions and preparing for tax season with accurate records, freelance web developers can optimize their tax liabilities and ensure compliance. This organized approach to financial management not only enhances profitability but also contributes to long-term business success.

To experience the benefits of a streamlined expense management process, freelancers are encouraged to sign up for a free trial of Minute7 and discover how its features can transform their financial management practices.