In today’s rapidly evolving financial landscape, digital transformation has become a crucial strategy for financial advisory firms aiming to enhance efficiency, comply with regulatory standards, and provide superior client service. By leveraging advanced technologies such as Customer Relationship Management (CRM) systems, financial planning software, and robust time tracking and expense reporting solutions like Minute7, financial advisors can streamline operations and maintain a competitive edge.

The Importance of Digital Transformation in Financial Advisory

Digital transformation refers to the integration of digital technology into all areas of a business, fundamentally altering how operations are conducted and value is delivered to clients (source). For financial advisory firms, this transformation is not merely about adopting new tools—it’s about leveraging these innovations to enhance client services, improve operational efficiency, and ensure regulatory compliance.

Several current trends are driving financial advisors to adopt digital tools:

- Increased Client Expectations: Today’s clients demand personalized, on-demand services that digital tools can provide. This includes easy access to financial information, tailored investment advice, and efficient communication channels (source).

- Regulatory Compliance: Growing regulatory requirements necessitate digital tools that help automate data collection, reporting, and ensure data security (source).

- Operational Efficiency: Automation and artificial intelligence (AI) streamline operations, reduce costs, and improve accuracy. Robotic process automation (RPA), for instance, can handle repetitive tasks, freeing advisors to focus on strategic activities (source).

- Data Analytics: Advanced analytics and AI offer deeper insights into client behaviors and market trends, enabling advisors to make more informed decisions and offer personalized advice (source).

The benefits of digital transformation for financial advisory firms are substantial:

- Improved Efficiency: Automation reduces manual effort, minimizes errors, and speeds up processes, allowing advisors to focus on client-facing activities that add more value (source).

- Enhanced Compliance: Digital tools ensure that data is collected, stored, and reported in compliance with regulatory standards, reducing the risk of non-compliance and associated penalties (source).

- Better Client Service: Digital tools enable advisors to offer more personalized and timely advice. Clients can access their financial information anytime, anywhere, enhancing transparency and trust (source).

- Data-Driven Insights: Leveraging data analytics helps advisors understand client needs better, predict market trends, and make data-driven decisions, resulting in more effective financial planning and investment strategies (source).

- Scalability: Digital solutions can easily scale to accommodate growth. As a firm expands, digital tools can handle increased volumes of data and transactions without a proportional increase in costs (source).

In conclusion, digital transformation is imperative for financial advisory firms looking to stay competitive in an evolving market. By adopting digital tools, firms can enhance operational efficiency, ensure compliance, improve client services, and leverage data for better decision-making. Minute7, with its robust time tracking and expense reporting solutions, plays a crucial role in this transformation by providing financial advisors with the tools they need to streamline operations and focus on delivering superior client service. Visit Minute7 to learn more about how our solutions can support your digital transformation journey.

Key Technologies for Digital Transformation in Financial Advisory

To achieve a successful digital transformation, financial advisory firms need to leverage a range of essential digital tools and technologies. These tools not only streamline operations but also enhance client service, ensuring that firms stay competitive in a tech-driven market.

Customer Relationship Management (CRM) Systems

CRM systems are vital for managing client interactions and data throughout the customer lifecycle. They help improve business relationships, assist in client retention, and drive sales growth. Leading CRM solutions in the financial advisory space include Salesforce Financial Services Cloud, Redtail Technology, and Wealthbox (source).

Benefits: * Enhanced Client Management: CRMs provide a centralized platform to manage client information, track interactions, and monitor engagement. * Improved Efficiency: Automated workflows and task management features streamline administrative tasks, allowing advisors to focus on client-facing activities. * Data-Driven Insights: Analytical tools help in segmenting clients based on various criteria, enabling personalized service and targeted marketing campaigns (source).

Financial Planning Software

Financial planning software helps advisors create comprehensive financial plans for their clients, including cash flow analysis, retirement planning, and tax optimization. Prominent solutions in this category include eMoney Advisor and MoneyGuidePro (source).

Benefits: * Comprehensive Planning: These tools enable advisors to present complex financial scenarios in a visually engaging manner, fostering better client understanding and collaboration. * Efficiency Gains: Automated calculations and scenario modeling save time and reduce the risk of errors. * Client Engagement: Interactive features help clients visualize their financial futures, making them more engaged in the planning process.

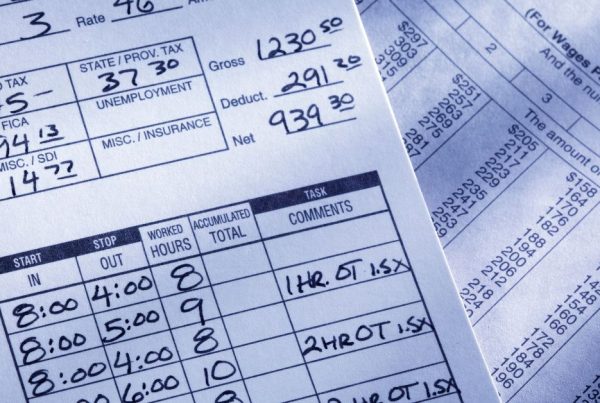

Time Tracking and Expense Reporting Solutions like Minute7

Time tracking and expense reporting are critical for managing billable hours and expenses efficiently. Minute7 provides a robust platform for financial advisory firms to track time and expenses against specific clients, jobs, or projects. With seamless integration with QuickBooks, it’s an excellent choice for firms relying on this popular accounting software (source).

Benefits: * Accurate Time Tracking: Minute7 allows advisors and their teams to log hours worked, ensuring accurate billing and payroll processing. * Expense Management: The platform offers features for tracking reimbursable and corporate credit card expenses, attaching receipts, and calculating mileage. * Seamless Integration: Integration with QuickBooks ensures that time and expense data syncs effortlessly for streamlined reporting and billing.

How Each Technology Contributes to Streamlining Operations and Enhancing Client Service

- CRM Systems: Centralizing client data and automating workflows reduces administrative burdens and enhances the personalization of client interactions, leading to improved satisfaction and retention.

- Financial Planning Software: These tools allow advisors to deliver precise and comprehensive financial advice. Detailed financial plans and scenario analysis build client trust and foster long-term relationships.

- Time Tracking and Expense Reporting Solutions: Tools like Minute7 ensure efficient management of time and expenses, reducing billing errors and ensuring compliance with financial tracking standards. This leads to smoother operations and better financial management.

Case Studies/Examples of Successful Digital Transformations in Financial Advisory Firms

- A Mid-Sized Advisory Firm Adopting a CRM System: Implementing Salesforce Financial Services Cloud resulted in a 30% increase in client satisfaction and a 20% reduction in administrative tasks.

- Small Advisory Firm Utilizing Financial Planning Software: Adopting eMoney Advisor increased client retention by 25% and improved client trust with robust scenario modeling.

- Freelance Financial Advisor Using Minute7: Using Minute7 for time and expense tracking reduced invoicing time by 50%, improving financial management and billing accuracy.

In summary, integrating these key technologies is essential for financial advisory firms aiming to streamline operations and enhance client service. Minute7, with its powerful time tracking and expense reporting features, plays a vital role in this digital transformation, helping firms manage their time and expenses effectively. Visit Minute7 to discover how our solutions can support your firm’s digital transformation journey.

Steps to Implement a Digital Transformation Strategy

Implementing a digital transformation strategy in financial advisory firms requires a structured approach. Here are the essential steps to guide your firm through this transformative journey:

Assessing Current Processes and Identifying Areas for Improvement

Objective: Understand the existing workflows, technologies, and pain points to establish a baseline for transformation.

Key Actions: – Conduct a comprehensive audit of current processes, including client onboarding, portfolio management, reporting, and compliance. – Identify inefficiencies, redundancies, and areas that could benefit from automation or digital tools. – Engage with staff to gather insights on daily operational challenges and potential improvements.

Supporting Research: – According to EY, assessing current legacy systems and operational models is crucial for financial services firms looking to become more agile and efficient. Upgrading legacy systems and adopting new technologies can lead to significant improvements in service delivery and operational efficiency.

Developing a Clear Digital Transformation Roadmap with Specific Goals and Timelines

Objective: Create a structured plan that outlines the steps, goals, and timelines for implementing digital transformation.

Key Actions: – Define clear, measurable goals such as improving client engagement, increasing operational efficiency, or enhancing data security. – Develop a timeline with milestones and deliverables to track progress and ensure accountability. – Allocate resources, including budget and personnel, to support the transformation efforts.

Supporting Research: – The Controllers Council emphasizes the importance of a well-defined roadmap that includes clear objectives and timelines. This roadmap serves as a blueprint for aligning people, processes, and technology to achieve transformation goals.

Selecting and Integrating the Right Digital Tools

Objective: Choose and implement digital tools that align with the firm’s goals and improve key areas of operation.

Key Actions: – Evaluate and select digital tools that meet the firm’s needs, such as CRM systems, portfolio management software, and communication platforms. – Integrate Minute7 for time tracking and expense reporting to streamline administrative tasks and ensure accurate billing. – Ensure that selected tools are compatible with existing systems and can be integrated seamlessly.

Supporting Research: – Investopedia lists essential tools for financial advisors, highlighting the importance of selecting technology that enhances client service and operational efficiency. Tools like Minute7 can help track time and expenses accurately, leading to better financial management and reporting.

Training Staff and Ensuring Continuous Support for New Technologies

Objective: Equip staff with the knowledge and skills needed to effectively use new digital tools and processes.

Key Actions: – Provide comprehensive training sessions for all staff members on the new tools and systems. – Establish a support system, including help desks and user manuals, to assist staff with any issues or questions. – Encourage a culture of continuous learning and adaptation to keep up with ongoing technological advancements.

Supporting Research: – Smart Insights highlights the importance of staff training and support in ensuring the success of digital transformation initiatives. Ongoing support and training help mitigate resistance to change and ensure smooth adoption of new technologies.

Measuring Success and Iterating on the Strategy

Objective: Continuously evaluate the effectiveness of the digital transformation strategy and make necessary adjustments.

Key Actions: – Establish key performance indicators (KPIs) to measure the success of the transformation efforts, such as client satisfaction, operational efficiency, and financial performance. – Collect feedback from staff and clients to identify areas for improvement. – Regularly review and update the digital transformation roadmap based on performance metrics and feedback.

Supporting Research: – According to Ultra Consultants, measuring the impact of digital transformation through KPIs is essential for understanding its success and making informed adjustments. Continuous iteration based on feedback and performance data ensures that the transformation remains aligned with the firm’s goals.

By following these steps, financial advisory firms can effectively implement a digital transformation strategy, enhancing operational efficiency, client service, and competitiveness. Minute7, with its robust time tracking and expense reporting solutions, can play a crucial role in this journey, helping firms streamline administrative tasks and focus on delivering superior client service. Visit Minute7 to learn more about how our solutions can support your digital transformation efforts.

Embracing Digital Transformation: The Path Forward for Financial Advisory Firms

In the ever-evolving landscape of the financial advisory industry, embracing digital transformation is not just a choice—it’s a necessity. By integrating advanced technologies such as CRM systems, financial planning software, and comprehensive time tracking and expense reporting solutions like Minute7, financial advisory firms can significantly enhance their operational efficiency and client service.

Throughout this article, we’ve explored the importance of digital transformation, identified key technologies essential for this journey, and outlined a structured approach to implementing a successful digital transformation strategy. The adoption of digital tools enables firms to improve client interactions, streamline processes, ensure compliance, and leverage data for informed decision-making.

Minute7 stands out as a crucial component in this transformative journey. By offering robust time tracking and expense reporting functionalities, Minute7 simplifies the administrative burden, allowing financial advisors to focus more on delivering exceptional client service. Its seamless integration with QuickBooks further ensures that time and expense data are accurately synced, facilitating efficient billing and reporting processes.

As financial advisory firms navigate the complexities of digital transformation, having reliable and efficient tools like Minute7 can make a significant difference. By adopting Minute7, firms can not only streamline their operations but also stay competitive in a tech-driven market.

Ready to embark on your digital transformation journey? Explore how Minute7 can support your firm’s needs and help you achieve operational excellence and superior client service.