Navigating expense reporting can be a daunting task for freelance web developers who juggle multiple projects and clients. Accurate expense tracking is not only essential for financial planning and tax preparation but also crucial for maintaining a clear understanding of one’s financial health. By implementing best practices and leveraging modern technology, such as mobile expense reporting apps, freelancers can streamline their financial management processes, reduce errors, and save valuable time.

Understanding the Importance of Expense Reporting for Freelancers

For freelance web developers, accurate expense reporting is a critical aspect of sustaining a successful business. With the nature of freelance work involving multiple projects and fluctuating income, maintaining precise records of all expenditures is imperative. This meticulous tracking aids in understanding the financial status of a business and plays a vital role during tax season by identifying deductible expenses that can significantly impact tax liabilities. Without diligent expense tracking, freelancers risk overlooking potential deductions, which can lead to higher taxes and reduced profitability.

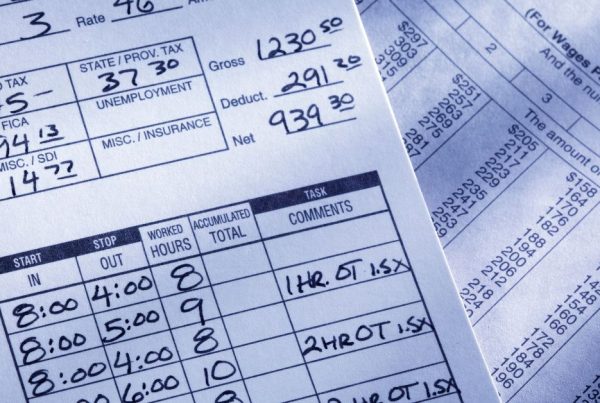

Expense tracking is integral to effective financial planning and tax preparation. By providing a clear view of spending patterns, it allows freelancers to manage budgets more effectively and exercise better cost control. Detailed expense records enable accurate forecasting of future expenses and income, contributing to long-term financial stability. During tax preparation, organized records simplify the identification of deductible expenses, thereby reducing taxable income and overall tax liability. This practice not only minimizes errors in tax filings but also ensures compliance with tax regulations.

Despite its importance, freelancers face several challenges in managing expenses. These include the irregularity of income, the diversity of expenses, and the complexity of tax compliance. With expenses ranging from software subscriptions to travel costs, keeping track of every expenditure can be overwhelming. Additionally, freelancers must manage their own taxes, including quarterly estimated payments and self-employment taxes, which can be complex without proper record-keeping. Many struggle to separate personal and business finances, leading to confusion during tax season. To address these challenges, freelancers can adopt best practices such as using dedicated business accounts and digital tools for expense tracking, helping them maintain a clear understanding of their financial health.

Best Practices for Streamlining Expense Reporting

For freelance web developers, adopting effective strategies for expense reporting can significantly enhance financial management and simplify tax preparation. Here are some best practices to streamline the process:

-

Categorizing and Organizing Expenses: Regularly track and categorize expenses to maintain clarity and efficiency in financial records. Consider using tools like spreadsheets or dedicated apps to classify expenses into categories such as software subscriptions, hardware purchases, and office supplies. This practice not only aids in identifying deductible expenses but also facilitates financial forecasting and budget management. Furthermore, maintaining separate accounts for personal and business expenses can prevent financial entanglements and simplify the tracking process. By using a dedicated business account and credit card, developers can ensure all transactions are business-related, making it easier to sort and report expenses efficiently.

-

Maintaining Regular Expense Documentation and Record-Keeping: Implement a routine for documenting every financial transaction to ensure comprehensive record-keeping. Utilize cloud-based tools for storing receipts, invoices, and other financial documents, enabling access from anywhere and ensuring organized records. This approach is particularly beneficial during audits or when reviewing financial history. Additionally, leveraging accounting software to automate record-keeping can save time and reduce errors. Such software tools often provide features like year-to-year expense comparisons, enhancing financial analysis capabilities.

-

Setting Up a Systematic Approach to Expense Reporting: Utilize dedicated tools and software designed for freelancers to streamline the expense reporting process. Applications like Minute7 integrate seamlessly with accounting systems, such as QuickBooks, enabling automatic data synchronization and simplifying reporting. Regularly review expenses to identify areas for cost optimization and ensure that financial decisions align with business goals. This practice not only maintains accurate records for tax deductions but also promotes a data-driven approach to financial management. Engaging in periodic reviews of expenses helps freelancers make informed decisions and optimize their spending effectively.

By implementing these best practices, freelance web developers can manage their business expenses more efficiently, ensuring a clear understanding of their financial health.

Leveraging Technology to Enhance Financial Management

In today’s digital age, freelance web developers can significantly benefit from using mobile expense reporting apps to simplify their financial management. These applications are essential for those who work remotely, providing tools for real-time tracking, automated receipt capture, and seamless integration with accounting software. By adopting these technologies, freelancers can efficiently manage their expenses on-the-go, reducing administrative burdens and maintaining organized financial records. This not only aids in managing cash flow but also prepares them for tax season, allowing more focus on their core work.

Among the various tools available, Minute7 stands out as a reliable solution. Minute7 offers a mobile expense reporting app that is particularly beneficial for freelancers needing a straightforward yet powerful tool for managing finances. Certified by QuickBooks, Minute7 provides seamless integration, ensuring that all time and expense data syncs effortlessly for accurate invoicing and reporting. This feature is especially advantageous for freelancers who need to bill clients accurately without losing time on manual data entry.

Here’s a step-by-step guide on utilizing Minute7 for efficient expense management and timely reporting:

-

Sign Up and Set Up: Start by signing up for a free trial. Once registered, configure your profile and link your QuickBooks account for seamless data synchronization.

-

Track Time and Expenses: Use the Minute7 app to log work hours and expenses as they occur. The app supports various devices, allowing easy tracking whether you’re at your desk or on the move.

-

Categorize Expenses: Organize expenses by projects or clients. Minute7 allows categorization, simplifying the generation of detailed reports and insights into spending patterns.

-

Generate Invoices: Sync data to QuickBooks to easily generate and send invoices. Minute7’s integration ensures all tracked time and expenses are accurately reflected, reducing errors and ensuring timely billing.

-

Review and Report: Utilize Minute7’s reporting features to review financial data. Generate comprehensive reports to gain insights into expenses and project profitability, aiding in better financial decision-making.

-

Continuous Monitoring: Regularly log into Minute7 to update entries and review reports. This practice helps maintain up-to-date records, crucial for tax preparation and financial health assessments.

By leveraging technology like Minute7, freelance web developers can enhance their financial management processes, streamline expense tracking and reporting, and ensure accurate invoicing and record-keeping.

Streamlining Expense Management for Freelancers with Minute7

In the dynamic world of freelancing, where projects and clients are ever-changing, managing expenses effectively is paramount. By utilizing best practices and embracing technology, freelance web developers can transform how they handle financial tasks, ultimately achieving greater clarity and efficiency in their business operations.

Minute7 emerges as a powerful ally for freelancers aiming to enhance their financial management. With its seamless integration with QuickBooks, Minute7 simplifies the complex task of expense tracking, allowing freelancers to focus more on their creative work. Its user-friendly mobile app ensures that tracking expenses is as easy as a few taps, providing real-time insights and automating the data synchronization process.

For those ready to take control of their financial health, Minute7 offers a comprehensive solution that not only streamlines expense reporting but also supports accurate invoicing and detailed financial analysis. The platform’s intuitive features empower freelancers to categorize expenses, generate invoices, and produce insightful reports effortlessly. By adopting Minute7, freelancers can reduce administrative burdens and focus on growing their business.

Take the first step towards efficient expense management by signing up for a free trial today. Discover how Minute7 can revolutionize your approach to financial management and support your journey towards sustainable business success.